The growing real estate market in Canada is attracting investors due to various reasons. Be it the ability to charge a premium in terms of rent or the increasing property prices or a shortage of living spaces in Canada, it is surely a lucrative proposition for investors. Then there are the stringent mortgage rules that compel buyers to purchase less expensive condos instead of homes. Although seasoned real estate investors and industry insiders know how to make informed decisions by crunching in all the numbers, what if you are a salaried person who aspires to buy a condo in Toronto?

The first question you might ask is, “How much money do I need to buy a condo in Toronto?” There are numerous factors involved that impact real estate property prices including the location, type of property, mortgages etc. Without considering all these factors, you cannot answer that question.

To give you a little perspective, Let’s look at some data first.

The average price of a home in Canada is $468,350

The average price of a home in Toronto is around $761,800

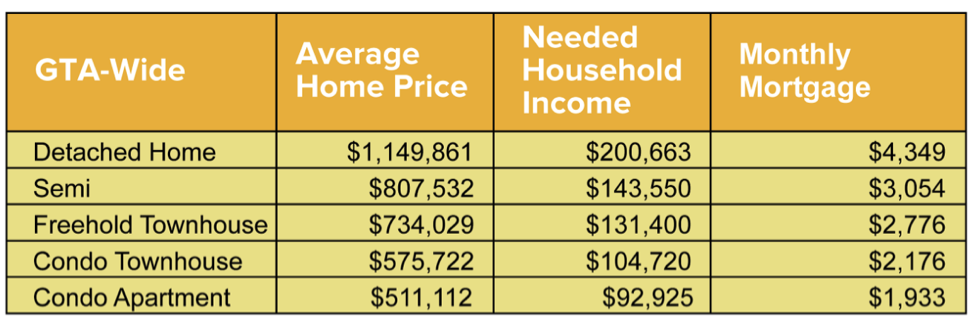

Average Home Prices With Respect To Property Type

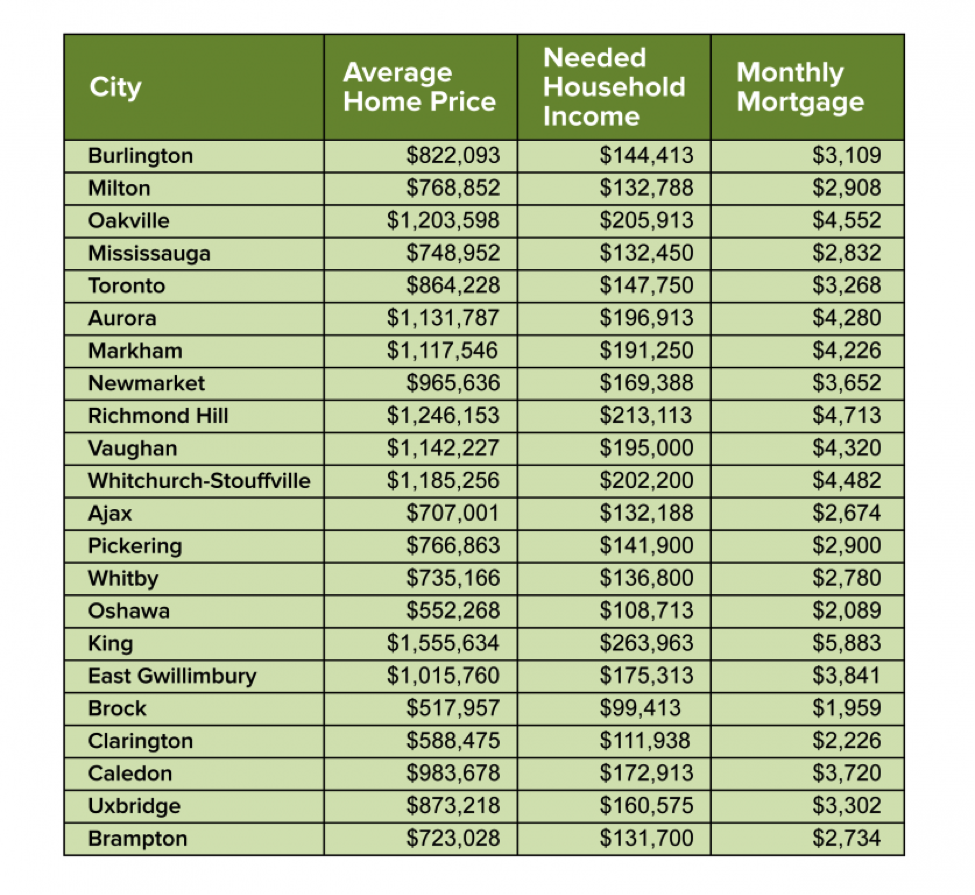

Average Home Prices In Different Localities

By looking at these numbers, you can get a clear picture about the property prices in Toronto based on location and property type. More importantly, you can also see how much household income you need to purchase each property and how much mortgages you will have to pay for it as well.

Generally, if you want to buy a real estate property in Toronto, you should have a household income of $145,000 and be ready to pay a mortgage of $2500 per month on an average. For those who want to invest in Toronto condos, they should have a household income of more than $90,000 and should be ready to pay approximately $2000 in terms of mortgages every month. The average price of condos in Toronto is a shade above $500,000.

Phew!

These numbers are overwhelming and might also dent some of your hopes for buying a condo in Toronto. Don’t worry, we have some tried and tested actionable tips for you that will help you buy a condo even if you are a salaried person. Read on to find out more.

5 Condo Buying Tips for Salaried Employees

Here are five effective tips that will help salaried employees in buying a condo.

1. Set Aside Money For Down Payments

There is nothing worse for your condo buying plans than not having a sufficient amount at your disposal for down payments. Here is a quick break down of money you should sidestep for down payments.

● Based on your credit history and condo location, you will need to spare 5% of the final price for resale condos or even more in some cases.

● Set aside 20% of the final price for pre-construction units. These charges are usually imposed by the builders and vary based on the stage of property development.

2. Have a Buffer for Closing Costs

If you think that buying a condo involves closing the deal, signing the agreement and moving in to your dream condo, you couldn’t be more wrong. It is not as simple as it seems. There are costs linked with closing a real estate deal that we call the closing costs.

Closing costs include the following:

● Sales Tax

● Lawyer and notary fees

● Land Transfer Tax

● Municipal levies

● Pre-paid condo fees

● Pre-paid municipal tax

● Bank and lender appraisal fee

You can avoid some of these closing costs except the legal fees, land transfer fee and municipal tax. Then there are the connection fees and moving expenses as well as the cost of maintenance that add up to the final costs. Yes, these are small amounts, but they do escalate quickly.

3. Reduce the Debt Load

One thing that many salaried employees overlook when buying a condo is debt load. It is the ratio of your total debt and income. Lenders use this metric to gauge the level of risk before lending you money. Remember, the lower the debt load, the better the mortgage rates you can get. Pay off all the debts and credit card bills to decrease your debt load. This will alleviate your debt load and increase the chances of securing a better mortgage deal.

4. Get a Better Deal with Mortgage Broker

As we are on the subject of securing a better mortgage rate, let’s discuss the role of a mortgage broker. The first thing you should do after you have made up your mind about purchasing a condo is to contact a mortgage broker. They are great at finding the best mortgage rates for you. Additionally, they have links in lending companies which you can never reach out to directly.

Bank usually don’t offer you the best rates and will waste a lot of your time on appointments or phone calls. Instead of going to a bank, you should opt for a reliable financial institution. Visit one of the accredited financial institutions that specialize in mortgages and you will be surprised to know that they charge much less as compared to banks because they don’t have any offices and overhead costs. What’s great about these brokers is that their services are free, and they only get a commission after the deal had been signed.

5. Improve Your Credit Score and Rating

Keep a close eye on your credit score and rating. If you live in Canada, checking your credit score doesn’t cost a thing. Order a copy of your credit file via mail by filling out a form. A lower credit score will portray a negative image of your financial conditions. This makes it harder for lenders to lend you money.

There are many reasons for poor credit scores and ratings. Some of them are:

● Poor credit utilization

● Delayed payments

● Opening and closing credit account frequently

● Unbalanced debt ratio

By avoiding some of the aforementioned things, you can keep your credit score in good health and avoid any penalties due to a poor credit score.

Did this article help you in purchasing a condo in Toronto as a salaried employee? Feel free to share your feedback with us in the comments section below.

Post a comment